Why does a monopoly never produce in the inelastic part of its demand curve?

This is a pretty standard question and it’s a good bet at some point when you start studying microeconomics you will get given this question as an exercise. It is also a question that is good to understand because if you get this you are on the way to getting some of the key concepts about elasticity and marginal revenue.

The first thing to understand is that, apart from the special case of constant elasticity where the demand curve is of the form , the elasticity will vary along different points of the demand curve. This is true even when the gradient of the demand curve is constant (ie the demand curve is linear). This is a point that sometimes confuses students about elasticity, they think “constant gradient = constant elasticity”…no it doesn’t.

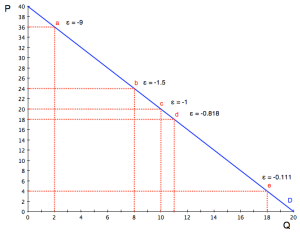

Here is an example, this is a simple demand function Q = 20-0.5P.

We can calculate the elasticity at different points, a, b, c, d and e.

Remember the definition of elasticity:

Elasticity of demand is the proportional change in quantity demanded divided by the proportional change in price:

which is generally expressed as

. This will generally be a negative value, because when you increase the price, you decrease the quantity, so

will be negative.

As these changes tend to zero (ie at the margin) we can express the elasticity as

.

Ifthen we say the demand is inelastic. If

then it is 'unit elastic'. If

then it is elastic.

With this demand function, , so the elasticity at different points will be

So at point a, the elasticity is 36/2 x -0.5 = -9

At point b, the elasticity is 24/8 x -0.5 = -1.5

At point c, the elasticity is 20/10 x -0.5 = -1

At point d, the elasticity is 18/11 x -0.5 = -0.818

At point e, the elasticity is 4/18 x -0.5 = -0.111

Notice that at point c, the mid point of the curve, the elasticity is -1, this is where the curve is unit elastic. Above point c, the curve is elastic, it gets more elastic the higher the price and lower the quantity. At the point where the price is 40 and the quantity is 0, the elasticity will be 40/0 x -0.5 which will be infinity. Below point c, the curve is inelastic and gets less elastic the lower the price and higher the quantity. At the point where the price is 0 and the quantity is 20, the elasticity will be 0/20 x -0.5 which will be 0.

We can now think of this with marginal revenue. and

so

.

Here the inverse demand function is so

and

. So we can draw in the marginal revenue curve MR = 40-4Q:

Notice how the marginal revenue is positive when the demand curve is elastic, it is zero when the demand curve is unit elastic and it becomes negative when the demand curve is inelastic.

This is the answer to the question. Given that the marginal revenue is the amount of revenue gained by selling an extra unit, nobody is going to sell an extra unit if the marginal revenue is negative (ie they lose money by selling it).

You can also think of this in an algebraic way. Given that , we can use the product rule to say

so

.

Now multiply both top and bottom parts of the right hand side of that equation by P so you get . We can factorise the P out of this to get

which can be rewritten slightly differently as

.

The right hand side of that equation is the inverse of the elasticity, , so

. This is a useful equation to remember.

Elastic demand is where and inelastic demand is where

. So now we can think of why a monopolist won't produce in the inelastic part of its demand curve. When demand is inelastic then

so

. And given that the price, P, is positive, it also follows that

. So the marginal revenue will be negative, and no firm will produce an extra unit if it means it loses money.